“How to get out of credit card debt without ruining your credit” involves using structured repayment strategies—such as the debt snowball or debt avalanche—combined with responsible financial tools like Debt Management Plans (DMPs), credit card hardship programs, and credit counseling. The objective is to eliminate your balances while preserving (or even improving) your credit score by ensuring timely payments, maintaining low utilization rates, and avoiding harmful tactics like settlement or bankruptcy.

Are credit card bills stressing you out? Do you want to pay off your debt, but you’re scared it might hurt your credit score?

You’re not alone. Many people feel the same way. The question most ask is: How to get out of credit card debt without ruining your credit?

The good news is this: You can pay off your credit card debt AND keep your credit score safe. In fact, doing things the right way might even help your score go up!

Let’s talk about how you can do this step by step, but first:

What Is a Credit Score and Why Does It Matter?

Your credit score is like a grade that shows how well you handle money you’ve borrowed. Lenders (like credit card companies and banks) look at your score to decide if they should let you borrow more money—or give you a loan. The higher your score, the better!

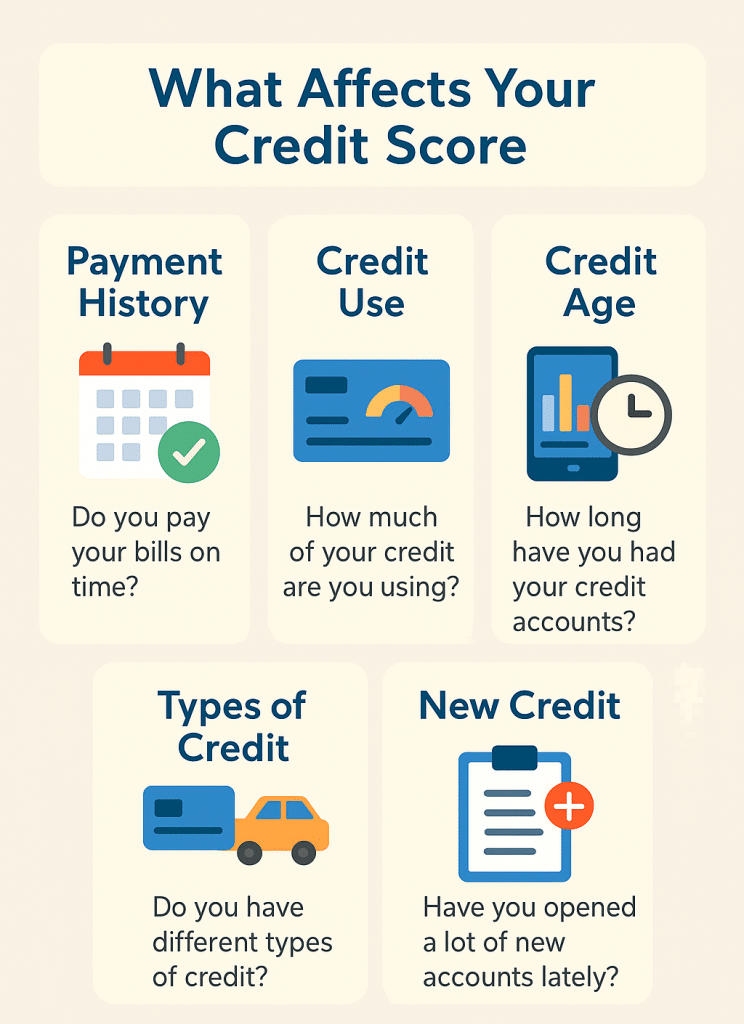

There are five main things that make up your credit score. Let’s break them down:

Payment History (This is the MOST important)

Do you pay your bills on time?

– Every time you pay a credit card, loan, or other bill late, it gets reported to the credit bureaus.

– A late payment can hurt your score—especially if it’s more than 30 days late.

– If you always pay on time, your credit score can go way up over time.

Tip: Set reminders or use auto-pay to never miss a payment!

Credit Use (Also called “credit utilization”)

How much of your credit are you using?

– This means how much money you owe compared to how much credit you’re allowed to use.

– Example: If your credit card has a $1,000 limit and you’re using $800, you’re using 80%—which is high!

– Experts recommend using less than 30% of your limit. So for a $1,000 card, that means staying under $300.

Tip: Paying your balance down helps your score go up.

Credit Age (Also called “length of credit history”)

How long have you had your credit cards or loans?

– The longer your accounts have been open, the better it looks.

– This shows that you’ve had credit for a while and know how to manage it.

– If you close an old account, it can actually lower your average credit age and hurt your score.

Tip: Even if you don’t use an old card much, keeping it open can help your score.

Types of Credit (Also called “credit mix”)

Do you have more than one kind of credit?

– There are two main types:

– Revolving credit (like credit cards)

– Installment loans (like car loans, student loans, or mortgages)

– Having a mix of different credit types shows that you can handle different responsibilities.

Note: You don’t need all kinds of credit—but having more than one type can help.

New Credit (Also called “recent inquiries”)

Have you opened a lot of new credit accounts recently?

– Every time you apply for a credit card or loan, it’s called a “hard inquiry.”

– Too many new accounts or hard inquiries in a short time can make lenders nervous.

– It might look like you’re taking on more debt than you can handle.

Tip: Only apply for credit when you really need it.

Bottom Line

To build a strong credit score:

– Pay on time

– Use only some of your credit

– Keep old accounts open

– Have a healthy mix of credit types

– Avoid applying for too much at once

Important: Using credit cards isn’t bad. What matters is how you use them.

Now onto the steps on how to get out of credit card debt without ruining your credit.

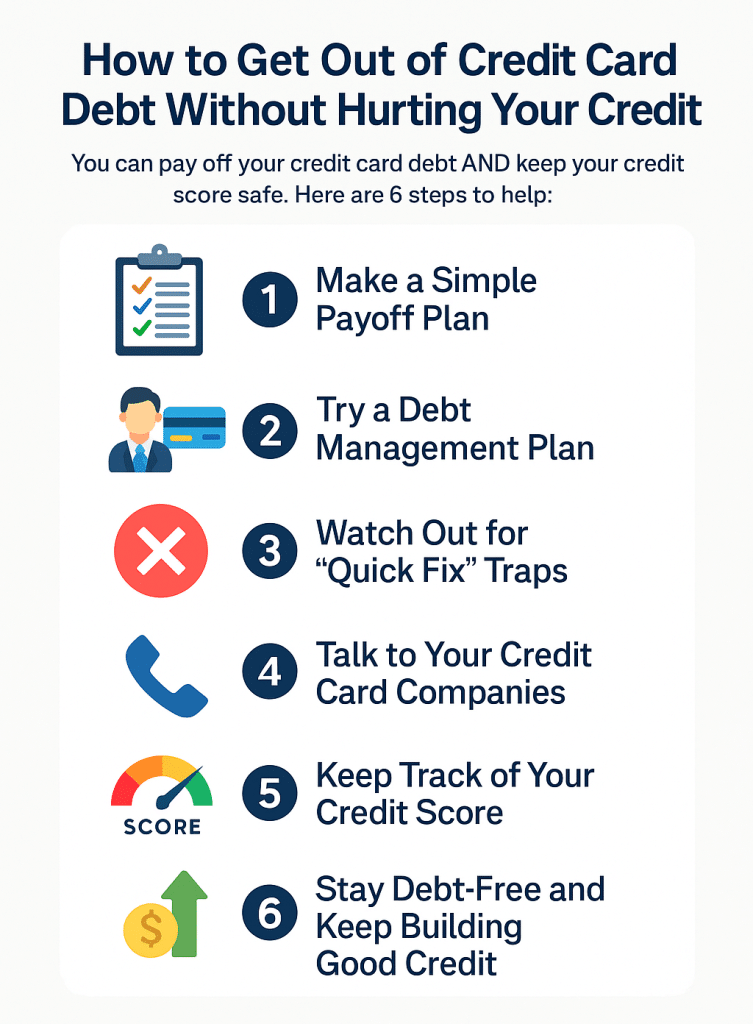

Step 1: Make a Simple Plan to Pay Off Your Debt

You don’t have to guess your way out of debt. There are smart ways to do it.

Option 1: The Snowball Method

This means you pay off your smallest debt first, while making minimum payments on the rest. Once the first card is paid off, move to the next smallest. It’s great because you feel proud and motivated quickly.

Option 2: The Avalanche Method

With this one, you pay off the card with the highest interest rate first. This saves you more money over time.

Both work. Just choose the one that feels right for you. And no matter what—always pay at least the minimum on every card so your credit doesn’t get hurt.

Tip: Set reminders or auto-pay so you never miss a payment!

Step 2: Try a Debt Management Plan (DMP)

If your debt feels too big or too hard to handle, you’re not stuck. A Debt Management Plan can help.

Here’s how it works:

– A credit counselor talks to your credit card companies.

– They ask for lower interest rates or smaller monthly payments.

– You make one easy monthly payment, and the counselor sends it to your creditors.

It’s not a loan. It’s a way to organize your debt so you can handle it better.

Most of the time, a DMP won’t hurt your credit. It might even help because you’re paying on time and reducing your debt.

Step 3: Watch Out for “Quick Fix” Traps

Some offers sound helpful—but can actually make things worse.

Debt Settlement

This is when a company offers to pay less than you owe. It sounds great, but it can hurt your credit score a lot, and there may be hidden fees or taxes.

Bankruptcy

This should be your very last option. It stays on your credit report for up to 10 years.

Balance Transfer Cards or Debt Consolidation Loans

Sometimes these can help, but they’re tricky. If you don’t use them wisely, you might end up with more debt, not less.

Step 4: Talk to Your Credit Card Companies

Are you struggling to make payments? Don’t hide from it. Call your credit card company and ask for help.

Many companies have hardship programs that:

– Lower your interest rates

– Give you more time to pay

– Help you avoid late fees

Try saying something like:

“Hi, I’m trying to stay current, but I’m having a hard time. Do you have any programs that could help me right now?”

Step 5: Keep Track of Your Credit Score

You don’t have to guess if your score is going up or down. There are free ways to check your score:

– AnnualCreditReport.com – Check your full credit report once a year for free.

– Credit Karma, Credit Sesame, or your bank’s app – These let you see your credit score anytime.

Also, look for mistakes in your report. If you see something wrong, you can ask to fix it—and that might boost your score!

Step 6: Stay Debt-Free and Keep Building Good Credit

Once you’ve paid off your cards, don’t stop there! Let’s keep that progress going:

– Don’t close your old credit cards (unless they have big yearly fees). Keeping them open helps your credit history.

– Use your card sometimes and pay it off in full.

– Save money for emergencies, so you don’t have to use credit cards again.

Final Thoughts: You’ve Got This

You don’t need to feel stuck. You don’t need to wreck your credit to get out of debt. With a smart plan, a little help, and steady steps, you can become debt-free and keep your credit score safe.

Need Help Getting Started?

At American Credit Foundation, we’ve helped thousands of people just like you take back control of their money. Our trained credit counselors are friendly, patient, and best of all—their help is free.

Click here to contact us today and start your journey to freedom and find out: How to get out of credit card debt without ruining your credit.