Debt can feel overwhelming—like you’re buried under bills with no way out. But what if there was a strategy that made debt repayment easier, more motivating, and even a little exciting? That’s exactly what the snowball method does.

This step-by-step system helps you pay off debt by starting small and building momentum, just like a snowball rolling downhill. The more it rolls, the bigger and faster it gets—until your debt is completely gone.

What Is the Snowball Method?

The snowball method is a popular debt repayment strategy where you focus on paying off your smallest debt first, regardless of interest rates. After each debt is paid off, you “roll” the payment amount into the next debt, creating a growing snowball of payments.

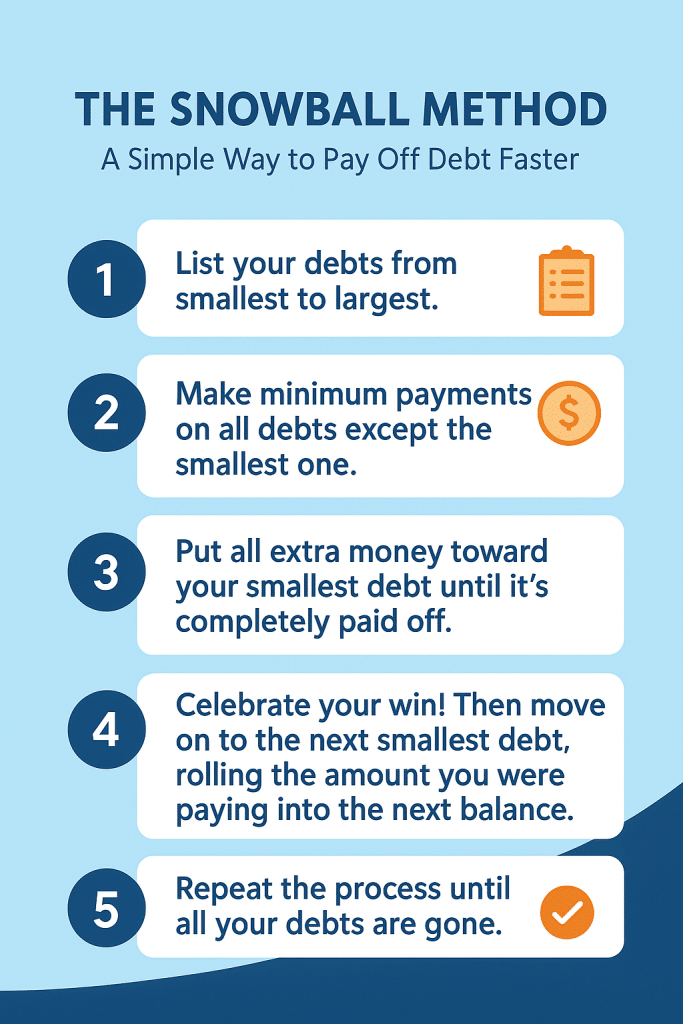

Here’s the process:

- List your debts from smallest to largest. Ignore the interest rates for now.

- Make minimum payments on all debts except the smallest one.

- Put all extra money (your “snowball”) toward the smallest balance.

- Celebrate your win when it’s paid off, then roll that payment into the next debt.

- Repeat until all debts are gone.

Over time, the payments you can put toward each debt grow larger and larger, creating powerful momentum.

Why the Snowball Method Works

The snowball method isn’t just about numbers—it’s about motivation. Here’s why it’s so effective:

- Quick wins keep you motivated. Paying off a small debt quickly gives you confidence to keep going.

- Momentum builds naturally. Each time you eliminate a debt, you have more money to put toward the next one.

- It’s easy to follow. You don’t need fancy calculators or financial knowledge—just a list and a plan.

- You stay engaged. Many people quit debt repayment because it feels slow. The snowball method keeps you emotionally invested.

Think of it as training your brain for success—small victories lead to bigger victories.

Example of the Snowball Method in Action

Let’s look at an example. Imagine you have four debts:

- Credit Card A: $400

- Credit Card B: $1,000

- Car Loan: $6,000

- Student Loan: $18,000

Here’s how the snowball method would play out:

- Pay minimums on everything but Credit Card A.

- Attack Credit Card A with all extra money until it’s gone.

- Roll the payment from Credit Card A into Credit Card B.

- After that’s gone, roll both payments into the Car Loan.

- Finally, use the full snowball to crush the Student Loan.

By the time you reach your largest debt, you’ll be making huge payments compared to where you started—helping you pay it off and become debt-free much faster than if you were spreading your money thinly.

Snowball Method vs. Avalanche Method

You may have also heard of the avalanche method, another debt payoff strategy. Instead of starting with the smallest balance, the avalanche method targets the highest-interest debt first to save money on interest.

- Avalanche method: Saves more money in interest but may take longer to see results.

- Snowball method: May cost slightly more in interest but delivers faster wins to keep you motivated.

If you’re highly disciplined and patient, the avalanche method could be a good choice. But if you’ve ever felt discouraged or stuck when paying off debt, the snowball method is more likely to keep you on track.

Tips For Success

The snowball method is simple, but you can make it even more powerful with a few smart habits:

1. Create a Realistic Budget

Know exactly how much money you can put toward your snowball each month. Even an extra $50 or $100 makes a big difference over time.

2. Cut Small Expenses

Little savings add up. Skip dining out for a month, cut unused subscriptions, or shop for cheaper insurance. Redirect those savings to your snowball.

3. Boost Your Income

Side jobs, freelance work, or selling unused items can supercharge your snowball. Even temporary extra income can help you crush debt faster.

4. Automate Payments

Set up automatic minimum payments so you never miss one, and then make extra snowball payments manually to stay engaged.

5. Celebrate Milestones

Paying off a credit card or loan is a big win—so celebrate! Reward yourself in a small but meaningful way (without adding more debt).

Common Mistakes to Avoid With the Snowball Method

While the snowball method is powerful, watch out for these pitfalls:

- Adding new debt. Don’t cancel out your progress by running up new balances.

- Skipping your emergency fund. Unexpected expenses can throw off your snowball. Build a small savings cushion first.

- Forgetting long-term goals. The snowball method helps with debt, but don’t neglect retirement savings once your debt is under control.

Is the Snowball Method Right for You?

The snowball method works best if:

- You need quick wins to stay motivated.

- You’ve struggled with debt repayment in the past.

- You prefer a clear, simple system you can stick to.

If you’re laser-focused on saving every penny in interest, the avalanche method may be a better fit. But for most people, the snowball method provides the perfect balance of structure and motivation.

Final Thoughts

The snowball method isn’t just about numbers—it’s about psychology. By focusing on small victories, you build confidence, gain momentum, and create a clear path toward financial freedom.

Debt doesn’t have to control your life. With the snowball method, you can take back control—one debt at a time—until you’re completely debt-free.

Start today. List your debts, make your plan, and push your first snowball downhill. Before you know it, your financial future will look brighter than ever

If you need additional help, contact one of our credit counselors for a free consultation.