Hey there! Let’s talk about something that could change your life for the better: getting debt help. You might have maxed out your credit cards and have significant amounts of debt, maybe it sounds a bit scary and is dragging you down. But don’t worry! We’re going to explore what types of debt help are available, and how they could make your life a whole lot better. So, let’s dive in and learn about the different options for getting debt help, how they work, and the pros and cons of each. Plus, we’ll discover the amazing benefits of becoming debt-free!

What is Debt Help?

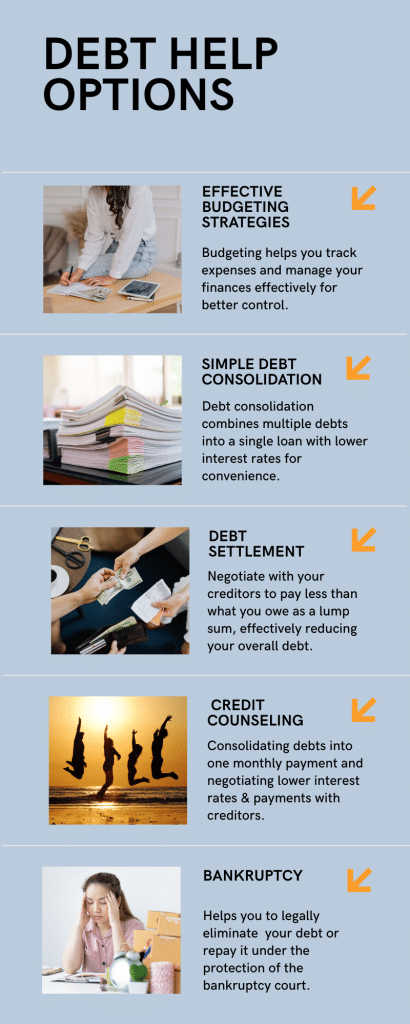

Getting debt help is like having a superhero by your side when you’re dealing with money problems. It’s all about finding ways to manage and reduce the money you owe to others. Whether it’s credit card bills, student loans, or other types of debt, the following debt help options can guide you to a brighter financial future.

Options for Debt Help

There are several options for debt help, and each one works a bit differently. Let’s explore them one by one:

1. Budgeting

Pros:

- Control Over Finances: Budgeting gives you a clear picture of your financial situation, helping you control your spending and saving habits.

- Customizable: You can tailor your budget to fit your lifestyle and financial goals.

- Empowering: Knowing where your money goes can empower you to make better financial decisions.

Cons:

- Time-Consuming: Setting up and maintaining a budget can take time and effort.

- Requires Consistency: You need to consistently track your expenses and adjust your budget as needed.

2. Debt Consolidation

Pros:

- Single Payment: Simplifies your finances by combining multiple debts into one payment.

- Potential Savings: Lower interest rates can save you money over time.

- Improved Credit Utilization: Could improve your credit score by reducing the amount of credit you’re using relative to your limits.

Cons:

- Fees and Costs: Some consolidation loans come with fees that can add to your debt.

- Risk of More Debt: Without discipline, you might accumulate more debt after consolidating.

3. Debt Settlement

Pros:

- Debt Reduction: You might pay less than you originally owed.

- Avoids Bankruptcy: Provides an alternative to filing for bankruptcy.

Cons:

- Credit Impact: Can negatively affect your credit score and remain on your credit report for years.

- Tax Implications: The forgiven debt might be considered taxable income.

4. Credit Counseling

Pros:

- Professional Support: Access to financial experts who can guide you through debt management.

- Reduced Interest Rates: Credit counseling agencies often negotiate with creditors to lower interest rates on your debts. This can significantly reduce the amount of interest you pay over time, making it easier to manage your debt.

- Lower Monthly Payments: By negotiating lower interest rates and possibly waiving certain fees, credit counseling can help reduce your overall monthly payments. This makes it more manageable to keep up with payments and stay on track with your debt management plan.

Cons:

- Possible Restrictions: Some plans may restrict the use of credit cards or require you to close existing accounts, which could impact your credit utilization ratio.

- Commitment Required: You need to stick to the debt management plan for it to be effective.

5. Bankruptcy

Pros:

- Debt Discharge: Can eliminate most unsecured debts, giving you a fresh start.

- Legal Protection: Stops collection activities and legal actions from creditors.

Cons:

- Severe Credit Impact: Stays on your credit report for up to 10 years, affecting your ability to get credit.

- Loss of Assets: Depending on the type of bankruptcy, you might have to sell assets to pay creditors.

By understanding the pros and cons of each debt help option, you’re better equipped to take control of your financial future. Remember, the journey to financial freedom is unique for everyone, so choose the path that best suits your needs and goals.

Benefits of Becoming Debt-Free

Now that we’ve explored the options for debt help, let’s talk about the amazing benefits of becoming debt-free:

- Peace of Mind:

- Reduced Stress: No more worrying about making ends meet or receiving collection calls.

- Mental Clarity: With financial burdens lifted, you can focus on other important aspects of life.

- Financial Freedom:

- More Choices: You can make decisions based on what you want, not just what you can afford.

- Opportunity to Pursue Dreams: Whether it’s starting a business or traveling, being debt-free opens up possibilities.

- Improved Credit Score:

- Better Loan Terms: A higher credit score can qualify you for better interest rates on loans and credit cards.

- Increased Trustworthiness: Lenders and landlords view you as a lower risk, making it easier to secure housing and credit.

- Better Relationships:

- Less Financial Conflict: Money is a common source of stress in relationships; being debt-free can reduce arguments and tension.

- Shared Goals: You can focus on shared financial goals, like saving for a home or retirement.

- Opportunity to Save and Invest:

- Emergency Fund: Build a safety net for unexpected expenses, reducing the need to rely on credit.

- Long-Term Wealth: Investing in retirement accounts or other opportunities can grow your wealth over time.

Conclusion

Getting debt help is like having a roadmap to a brighter financial future. Whether you choose budgeting, debt consolidation, debt settlement, credit counseling, or even bankruptcy, each option has its pros and cons. The key is to find the right path for you and stick with it. Remember, becoming debt-free is not just about money; it’s about gaining peace of mind, financial freedom, and a happier life. So, take the first step today and start your journey to a debt-free future!